POSR share

Share price

POSR share price

LJSE: POSR

€--,--

- --,-- % --. --- ----

Exchange information

Shares issued

17,219,662

Ticker symbol

POSR

ISIN code

SI0021110513

Stock exchange

Ljubljana Stock Exchange

Bloomberg symbol

POSR SV Equity

Share price performance

| Date | Average price | Change in % | Turnover 000 € | Volume |

|---|

Key indicators

| 31 Dec 2021 | 31 Dec 2022 | 31 Dec 2023 | 31 Dec 2024 | |

|---|---|---|---|---|

| Share capital (€) | 71,856,376 | 71,856,376 | 71,856,376 | 71,856,376 |

| Number of shares | 17,219,662 | 17,219,662 | 17,219,662 | 17,219,662 |

| Number of own shares | 1,721,966 | 1,721,966 | 1,721,966 | 1,721,966 |

| Ticker symbol | POSR | POSR | POSR | POSR |

| Number of shareholders | 4,274 | 4,316 | 4,376 | 4,422 |

| Closing share price in period (€) | 27.90 | 22.40 | 28.00 | 40,00 |

| Market capitalisation (€) | 432,385,718 | 347,148,390 | 433,935,488 | 619,907,840 |

| Consolidated net earnings per share (€) | 4.91 | 4.39 | 4.16 | 5.66 |

| Consolidated book value per share (€) | 32.53 | 26.58 | 37.79 | 41.85 |

| Price-to-book ratio | 0.86 | 0.84 | 0.74 | 0.96 |

| Price-to-premium ratio | 0.59 | 0.45 | 0.49 | 0.62 |

| Dividend per share for the year ended (€) | 1.50 | 1.60 | 1.75 | 2.25 |

Dividend

Sava Re follows its dividend policy. Generally, we distribute dividends once a year by a resolution of the general meeting of shareholders. Dividends approved in the general meeting are paid to shareholders shown in the share register on the record date.

Dividend payout ratio compared to dividend and earnings per share

| 2015 | 2,02 | 0,80 | 37 |

| 2016 | 2,08 | 0,80 | 38 |

| 2017 | 2,00 | 0,80 | 40 |

| 2018 | 2,76 | 0,95 | 34 |

| 2019 | 3,22 | 0,00 | 0 |

| 2020 | 3,63 | 0,85 | 23 |

| 2021 | 4,91 | 1,50 | 31 |

| 2022 | 4,39 | 1,60 | 36 |

| 2023 | 4,16 | 1,75 | 42 |

| 2024 | 5,66 | 2,25 | 40 |

Consolidated earnings per share (basic and diluted)

Dividend paid per share (payment in next year)

Dividend as % of consolidated profit

| General meeting resolution | Period | Gross dividend per share (€) | Dividend payment start date |

|---|---|---|---|

| 41th general meeting | 2024 | 2.25 | 11/06/2025 |

| 40th general meeting | 2023 | 1.75 | 12/06/2024 |

| 39th general meeting |

2022 | 1.60 | 21/06/2023 |

| 38th general meeting | 2021 | 1.50 | 12/07/2022 |

| 37th general meeting |

2020 | 0.85 | 10/06/2021 |

| 36th general meeting | 2019 |

- |

- |

| 35th general meeting | 2018 | 0.95 | 14/06/2019 |

| 34th general meeting | 2017 | 0.80 | 14/06/2018 |

| 33rd general meeting | 2016 | 0.80 | 20/06/2017 |

| 31st general meeting | 2015 | 0.80 | 29/09/2016 |

| 30th general meeting | 2014 | 0.55 | 14/07/2015 |

| 29th general meeting | 2013 | 0.26 | 25/08/2014 |

Dividend policy

Sava Re aims to increase its dividend by an average of 10% per year over the period 2023–2027, thus distributing each year between 35% and 45% of the net profit of the Sava Insurance Group. In preparing its annual dividend proposal, the Company will consider:

- the estimated surplus of eligible own funds over the solvency capital requirement under Solvency II,

- the Group’s own risk and solvency assessment,

- the capital models of S&P Global Ratings and AM Best,

- the approved annual and strategic plans of the Group and the Company,

- new development projects to engage additional capital and

- any other relevant circumstances affecting the financial situation of the Company.

Share buy-back

Overview of purchases completed under the buy-back programme (in accordance with Article 4(4) of Regulation (EC) No. 2273/2003)

On the basis of the Slovenian Companies Act (ZGD), the 28th general meeting of shareholders, which took place on 23 April 2014, granted the management board of Sava Reinsurance Company authorisation to acquire own shares. The general meeting authorisation is for acquiring up to a total of 1,721,966 shares, representing 10% of the Company’s share capital, including own shares held by the Company at the date of the authorisation. The general meeting authorisation was valid until 23 April 2017. In accordance with this authorisation, the Company could acquire its own shares in or outside the regulated financial instruments market.

In line with this general meeting authorisation, the Company started repurchasing its shares in July 2014.

Initially, it acquired own shares only on the regulated market, but as of the publication date of the programme on 18 November 2014, the Company made purchases both on the regulated market of financial instruments and outside this market, in line with its general meeting authorisation.

The Company has now bought back the maximum number of shares approved by shareholders.

Share repurchase programme

The share repurchase programme was also posted on the official website of the Ljubljana Stock Exchange through the SEOnet information system.

The share repurchase programme is available to the Company’s shareholders in the secretary’s office at the Company’s headquarters in Ljubljana, Dunajska cesta 56, every working day between 9am and 3pm.

Number of shares: 17,219,662 | Last updated: 22/04/2016

Resolutions of the 28th General Meeting of Shareholders of Sava Reinsurance Company

| Date | Number of shares acquired | Percentage of share capital (%) | Price per share (€) |

Purchased volume (€) |

|---|---|---|---|---|

| 11/04/2016 | 845,599 | 4.9107 | 15.00 | 12,683,985.00 |

| 7/04/2016 | 12,921 | 0.0750 | 14.07 | 181,798.47 |

| 6/04/2016 | 12,789 | 0.0743 | 14.10 | 180,324.90 |

| 5/04/2016 | 12,635 | 0.0734 | 14.30 | 180,680.50 |

| 1/04/2016 | 11,852 | 0.0688 | 14.50 | 171,854.00 |

| 31/03/2016 | 10,408 | 0.0604 | 14.46 | 150,499.68 |

| 30/03/2016 | 150 | 0.0009 | 14.35 | 2,152.50 |

| 30/03/2016 | 10,253 | 0.0595 | 14.40 | 147,643.20 |

| 29/03/2016 | 1,255 | 0.0073 | 14.31 | 17,959.05 |

| 29/03/2016 | 8,080 | 0.0469 | 14.30 | 115,544.00 |

| 29/03/2016 | 909 | 0.0053 | 14.32 | 13,016.88 |

| 24/03/2016 | 1,528 | 0.0089 | 14.30 | 21,850.40 |

| 23/03/2016 | 350 | 0.0020 | 14.10 | 4,935.00 |

| 22/03/2016 | 10,308 | 0.0599 | 14.00 | 144,312.00 |

| 21/03/2016 | 10,121 | 0.0588 | 14.01 | 141,795.21 |

| 17/03/2016 | 10,052 | 0.0584 | 14.01 | 140,828.52 |

| 16/03/2016 | 1 | 0.0000 | 13.90 | 13.90 |

| 15/03/2016 | 9,823 | 0.0570 | 14.00 | 137,522.00 |

| 23/02/2016 | 484 | 0.0028 | 12.02 | 5,817.68 |

| 22/02/2016 | 458 | 0.0027 | 12.10 | 5,541.80 |

| 17/02/2016 | 484 | 0.0028 | 12.00 | 5,808.00 |

| 15/02/2016 | 416 | 0.0024 | 11.92 | 4,958.72 |

| 12/02/2016 | 468 | 0.0027 | 12.10 | 5,662.80 |

| 11/02/2016 | 427 | 0.0025 | 12.32 | 5,260.64 |

| 9/02/2016 | 403 | 0.0023 | 12.50 | 5,037.50 |

| 9/02/2016 | 144 | 0.0008 | 12.21 | 1,758.24 |

| 5/02/2016 | 634 | 0.0037 | 12.50 | 7,925.00 |

| 2/02/2016 | 665 | 0.0039 | 12.53 | 8,332.45 |

| 29/01/2016 | 20 | 0.0001 | 12.50 | 250.00 |

| 26/01/2016 | 855 | 0.0050 | 12.50 | 10,687.50 |

| 21/01/2016 | 160 | 0.0009 | 12.00 | 1,920.00 |

| 20/01/2016 | 400 | 0.0023 | 12.10 | 4,840.00 |

| 20/01/2016 | 524 | 0.0030 | 12.05 | 6,314.20 |

| 18/01/2016 | 951 | 0.0055 | 12.02 | 11,426.27 |

| 15/01/2016 | 525 | 0.0030 | 12.27 | 6,441.75 |

| 15/01/2016 | 428 | 0.0025 | 12.11 | 5,183.08 |

| 14/01/2016 | 528 | 0.0031 | 12.36 | 6,526.08 |

| 14/01/2016 | 125 | 0.0007 | 12.16 | 1,520.00 |

| 14/01/2016 | 275 | 0.0016 | 12.10 | 3,327.50 |

| 12/01/2016 | 439 | 0.0025 | 12.31 | 5,401.90 |

| 12/01/2016 | 400 | 0.0023 | 12.30 | 4,920.00 |

| 11/01/2016 | 206 | 0.0012 | 12.50 | 2,575.00 |

| 11/01/2016 | 192 | 0.0011 | 12.55 | 2,409.60 |

| 11/01/2016 | 400 | 0.0023 | 12.53 | 5,012.00 |

| 8/01/2016 | 100 | 0.0006 | 12.53 | 1,253.00 |

| 7/01/2016 | 300 | 0.0017 | 12.57 | 3,771.00 |

| 30/12/2015 | 379 | 0.0022 | 12.70 | 4,813.30 |

| 30/12/2015 | 300 | 0.0017 | 12.64 | 3,792.00 |

| 29/12/2015 | 159 | 0.0009 | 12.80 | 2,035.20 |

| 29/12/2015 | 485 | 0.0028 | 12.85 | 6,232.25 |

| 23/12/2015 | 370 | 0.0021 | 12.78 | 4,728.60 |

| 21/12/2015 | 543 | 0.0032 | 13.13 | 7,129.59 |

| 18/12/2015 | 300 | 0.0017 | 13.30 | 3,990.00 |

| 17/12/2015 | 200 | 0.0012 | 13.30 | 2,660.00 |

| 17/12/2015 | 264 | 0.0015 | 13.24 | 3,494.04 |

| 16/12/2015 | 470 | 0.0027 | 13.20 | 6,204.00 |

| 14/12/2015 | 58 | 0.0003 | 13.16 | 763.28 |

| 11/12/2015 | 462 | 0.0027 | 13.72 | 6,336.33 |

| 7/12/2015 | 421 | 0.0024 | 13.70 | 5,767.70 |

| 3/12/2015 | 195 | 0.0011 | 13.80 | 2,691.00 |

| 30/11/2015 | 188 | 0.0011 | 13.63 | 2,562.44 |

| 26/11/2015 | 338 | 0.0020 | 13.81 | 4,667.78 |

| 24/11/2015 | 200 | 0.0012 | 13.60 | 2,720.00 |

| 24/11/2015 | 123 | 0.0007 | 13.60 | 1,672.80 |

| 18/02/2015 | 184 | 0.0011 | 16.21 | 2,982.64 |

| 16/02/2015 | 300 | 0.0017 | 16.30 | 4,890.00 |

| 9/02/2015 | 229 | 0.0013 | 16.00 | 3,664.00 |

| 9/02/2015 | 46 | 0.0003 | 15.70 | 722.20 |

| 5/02/2015 | 188 | 0.0011 | 16.01 | 3,009.88 |

| 4/02/2015 | 82 | 0.0005 | 15.26 | 1,251.32 |

| 3/02/2015 | 40 | 0.0002 | 15.71 | 628.20 |

| 3/02/2015 | 328 | 0.0019 | 16.31 | 5,349.68 |

| 28/01/2015 | 5 | 0.0000 | 15.85 | 79.25 |

| 28/01/2015 | 270 | 0.0016 | 15.90 | 4,293.00 |

| 28/01/2015 | 32 | 0.0002 | 16.01 | 512.32 |

| 23/01/2015 | 310 | 0.0018 | 15.95 | 4,944.50 |

| 22/01/2015 | 504 | 0.0029 | 15.63 | 7,877.52 |

| 21/01/2015 | 259 | 0.0015 | 15.80 | 4,092.20 |

| 20/01/2015 | 624 | 0.0036 | 15.90 | 9,921.60 |

| 16/01/2015 | 615 | 0.0036 | 16.00 | 9,840.00 |

| 15/01/2015 | 385 | 0.0022 | 15.80 | 6,083.00 |

| 14/01/2015 | 385 | 0.0022 | 16.01 | 6,161.93 |

| 14/01/2015 | 275 | 0.0016 | 16.00 | 4,400.00 |

| 13/01/2015 | 56 | 0.0003 | 15.90 | 890.40 |

| 13/01/2015 | 605 | 0.0035 | 16.00 | 9,680.00 |

| 12/01/2015 | 305 | 0.0018 | 16.00 | 4,880.00 |

| 12/01/2015 | 400 | 0.0023 | 15.90 | 6,360.00 |

| 7/01/2015 | 450 | 0.0026 | 16.10 | 7,245.00 |

| 7/01/2015 | 8 | 0.0000 | 16.00 | 128.00 |

| 6/01/2015 | 1 | 0.0000 | 16.35 | 16.35 |

| 6/01/2015 | 50 | 0.0003 | 16.30 | 815.00 |

| 5/01/2015 | 1,023 | 0.0059 | 16.20 | 16,572.60 |

| 5/01/2015 | 277 | 0.0016 | 16.30 | 4,515.10 |

| 30/12/2014 | 50 | 0.0003 | 15.50 | 775.00 |

| 30/12/2014 | 544 | 0.0032 | 15.49 | 8,426.56 |

| 30/12/2014 | 264 | 0.0015 | 15.60 | 4,118.40 |

| 29/12/2014 | 1,105 | 0.0064 | 15.38 | 16,989.38 |

| 22/12/2014 | 1,856 | 0.0108 | 16.10 | 29,881.60 |

| 18/12/2014 | 494 | 0.0029 | 15.16 | 7,489.04 |

| 17/12/2014 | 2,386 | 0.0139 | 15.40 | 36,744.40 |

| 16/12/2014 | 3,210 | 0.0186 | 15.20 | 48,792.00 |

| 15/12/2014 | 32 | 0.0002 | 15.60 | 499.20 |

| 2/12/2014 | 368,099 | 2.1377 | 16.30 | 6,000,013.70 |

| 23/10/2014 | 456 | 0.0026 | 15.01 | 6,844.56 |

| 20/10/2014 | 386 | 0.0022 | 15.00 | 5,790.00 |

| 17/10/2014 | 52 | 0.0003 | 14.61 | 759.72 |

| 16/10/2014 | 368 | 0.0021 | 14.94 | 5,497.92 |

| 14/10/2014 | 100 | 0.0006 | 15.00 | 1,500.00 |

| 14/10/2014 | 74 | 0.0004 | 15.01 | 1,110.74 |

| 14/10/2014 | 300 | 0.0017 | 15.02 | 4,506.00 |

| 14/10/2014 | 371 | 0.0022 | 15.02 | 5,572.42 |

| 25/07/2014 | 710 | 0.0041 | 13.97 | 9,918.70 |

| 24/07/2014 | 1 | 0.0000 | 13.26 | 13.26 |

| 22/07/2014 | 329 | 0.0019 | 14.00 | 4,606.00 |

| 14/04/2014 | 346,433 | 2.0118 | 11.25 | 3,895,639.09 |

| 25/04/2013 | 210 | |||

| 1,721,966 | 9.9988 | 24,876,150.59 |

Share ownership

POSR shares held by members of the supervisory and management boards as at 13 June 2025

| Number of shares | Holding | |

|---|---|---|

| Marko Jazbec, chair of the management board | 12,250 | 0.071% |

| Polona Pirš, member of the management board | 4,318 | 0.025% |

| Peter Skvarča, member of the management board | 1,200 | 0.007% |

| David Benedek, member of the management board | 1,350 | 0.008% |

Source: Central securities register with KDD d.o.o.

Analyst coverage

Analyst coverage links

|

|

ODDO BHF |

Analysis available (July 2024) |

|

inter.capital |

|

The analysis of ODDO BHF has been commissioned and paid for by Sava Re d.d., Ljubljana (“Sava Re”); however, Sava Re has not provided the analyst with any instructions or data or otherwise influenced the preparation of the analysis. The analysis is based solely on publicly available data.

The other financial analysts listed are independent of Sava Re and have not carried out their research at the request of, or for a fee from, Sava Re.

The analyses of the market value of POSR shares available from each of the above analysts and the opinions, estimates and forecasts contained therein are independent and reflect the professional judgement of the analysts who prepared them. They do not represent the opinions, estimates or forecasts of Sava Re or its management, nor should they be considered as recommendations to enter into transactions in Sava Re shares.

The list of analysts and any related information do not constitute an offer to sell or the solicitation of an offer to buy any securities of Sava Re and should not be relied upon as a basis or fact upon which any recipient of such information should base any decision to buy or sell any securities of Sava Re. Any recipient of the above information who intends to purchase any financial instruments or assets of Sava Re should make their own independent assessment of Sava Re’s financial performance and position and their own independent assessment of Sava Re’s creditworthiness. Any individual or legal entity considering investing in financial instruments or assets of Sava Re should first seek the advice of a professionally qualified financial adviser.

Sava Re assumes no obligation to update this list, nor does Sava Re distribute any information or reports from analysts.

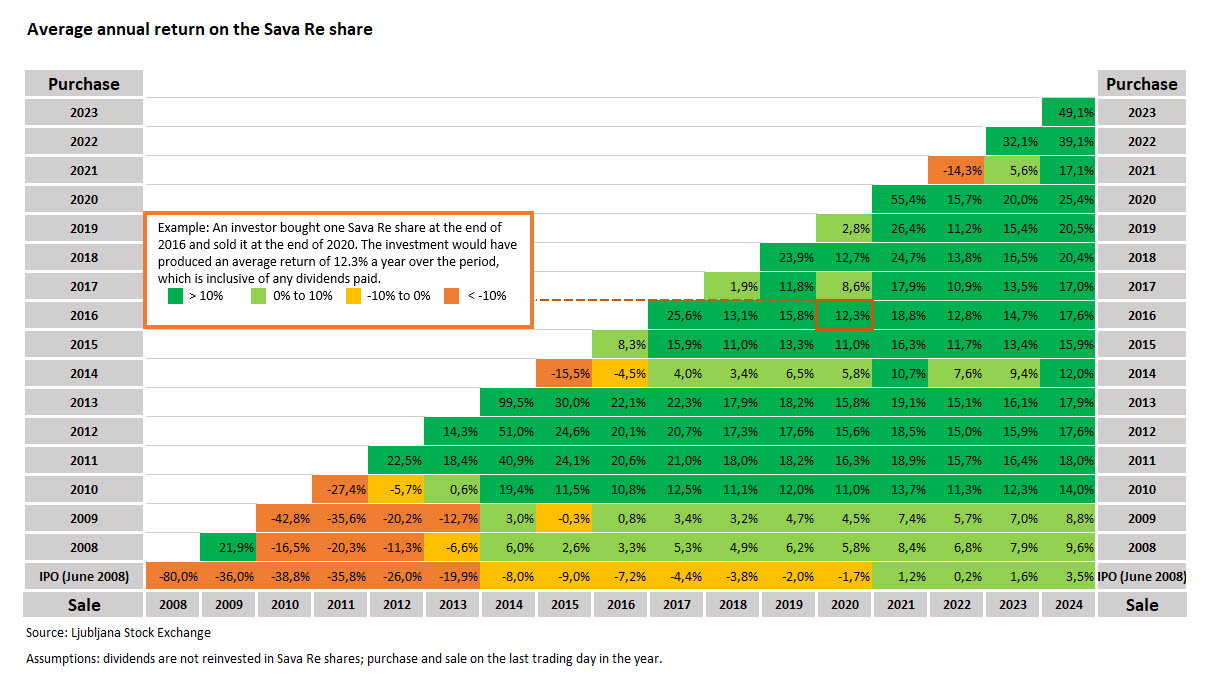

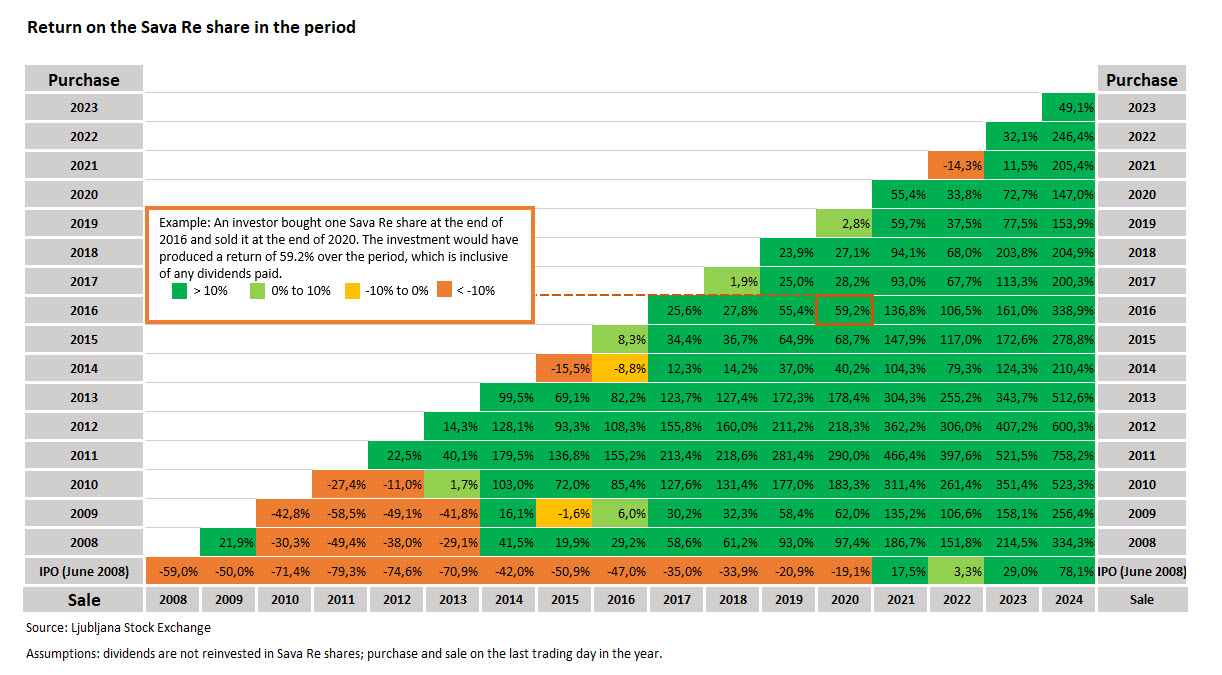

Share performance

What was the return for an investor who invested in the Sava Re share in the 2008 initial public offering?

Click on the table to enlarge

How to read this table?

Example in first table: An investor bought one Sava Re share at the end of 2016 and sold it at the end of 2020. The investment would have produced an average return of 12.3% a year, which is inclusive of any dividends paid.