3 July 2014

Agreement to Improve International Tax Compliance and to Implement FATCA

FATCA (Foreign Account Tax Compliance Act) is a United States law that was enacted on 18 March 2010 to enter into force on 1 July 2014. The purpose of FATCA is to improve compliance of U.S. taxpayers who hold financial assets outside the U.S. through the introduction of a reporting regime for financial institutions with respect to such assets.

FATCA requires that non-U.S. financial institutions identify U.S. financial account holders and entities controlled by U.S. taxpayers, and to report on the financial assets of such entities.

Financial institutions that do not participate in the FATCA regime will be subject to a special FATCA tax of 30 percent on all taxable payments from the U.S., regardless of whether the recipient of such payment is the financial institution itself or its clients.

In order to remove domestic legal impediments to compliance, the U.S. Treasury Department has collaborated with foreign governments to develop Intergovernmental Agreements (IGA) for FATCA implementation in several forms.

The Agreement between the Government of the Republic of Slovenia and the Government of the United States of America to Improve International Tax Compliance and to Implement FATCA was signed on 2 June 2014. The Agreement follows IGA Model 1, including reciprocity in the exchange of information between the countries and sets out the obligations of Slovenian financial institutions and the Tax Administration of the Republic of Slovenia regarding the implementation of FATCA.

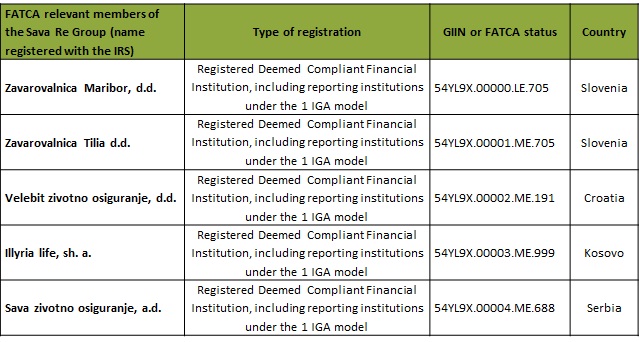

In accordance with the Agreement, the Sava Re Group insurers authorised to transact life insurance business (Zavarovalnica Maribor d.d., Zavarovalnica Tilia d.d., Velebit životno osiguranje d.d., Sava životno osiguranje d.d. and Illyria Life, sh. a .) registered with the U.S. tax authorities to obtain relevant FATCA status.

Pozavarovalnica Sava d.d. (Sava Reinsurance Company), the parent company of the Sava Re Group, has not registered with the IRS as under the rules of the Agreement, it is a "non-financial foreign institution" (NFFE).

Zavarovalnica Maribor d.d. will act as a lead financial institution for FATCA relevant members of the Sava Re Group for the implementation of FATCA rules and registration with the IRS:

The Sava Re Group is FATCA compliant and implements FATCA rules as from 1 July 2014. Individual Sava Re Group members offer neither legal nor tax advice on U.S. taxation nor services regarding tax obligations of persons in the United States of America.

Useful links:

USA:

http://www.treasury.gov/resource-center/tax-policy/treaties/Pages/FATCA.aspx

http://slovenia.usembassy.gov/

Slovenia:

http://www.mf.gov.si/si/delovna_podrocja/davki_in_carine/dokumenti/fatca/

http://www.durs.gov.si/si/delovna_podrocja/mednarodno_sodelovanje_v_davcnih_zadevah/

EU Commission:

http://ec.europa.eu/taxation_customs/taxation/tax_fraud_evasion/index_en.htm

OECD:

http://www.oecd.org/ctp/exchange-of-tax-information/

Please find detailed information in the attached brochure.

Please find attached also a W-8BEN-E Form.

News

16 May 2025

Solvency and Financial Condition Report of the Sava Insurance Group for 2024

Pursuant to the rules of the Ljubljana Stock Exchange and the Market in Financial Instruments Act, Sava Re d.d., Dunajska 56, Ljubljana, makes the following...

16 May 2025

First-quarter results for 2025: Sava Insurance Group posts strong pre-tax profit of €39m

In accordance with the rules of the Ljubljana Stock Exchange, Ljubljana, and the Market in Financial Instruments Act, Sava Re d.d., Dunajska 56, Ljubljana, makes...

9 April 2025

Notice of 41st general meeting of shareholders

Pursuant to the rules of the Ljubljana Stock Exchange and applicable regulations, the management board of Sava Re d.d. hereby calls the 41st general meeting of...